Plans to build a nuclear power station at Moorside in Cumbria, northwest England took a potentially fatal hit yesterday after Japanese engineer Toshiba said it was winding up the NuGen subsidiary that was to have built it.

The decision follows the failure of detailed talks over the sale of NuGen to state-backed Chinese and South Korean nuclear companies.

UK scientists’ union Prospect called for state intervention to save the scheme after the announcement, calling it “devastating news for Cumbria and the wider energy sector”.

Toshiba’s statement yesterday said: “Toshiba recognises that the economically rational decision is to withdraw from the UK nuclear power plant construction project, and has resolved to take steps to wind up NuGen.”

It added that it would lose $131.7m (15 billion yen) as a result of of shutting NuGen.

A spokesman for the UK government’s business department said: “We understand that Toshiba have faced a difficult decision in ending their involvement in new nuclear projects outside of Japan in light of their well-known financial challenges.

“All proposed new nuclear projects in the UK are led by private sector developers and while the government has engaged regularly with the companies involved, this is entirely a commercial decision for Toshiba.”

Sue Ferns, senior deputy general secretary of scientists’ union Prospect, called for state intervention to save the scheme, saying the future of the UK nuclear industry was at stake.

“The nuclear industry and wider supply chain currently employ thousands of people in the North West of England. The long term future of this could be on the line if we can’t move forward with building Moorside,” she said.

She added: “As Toshiba has opted to pull the plug on this project then the government must step in. Our analysis shows that if the government were to take a 50% stake then there would be a net benefit to the public purse, so there really is no excuse not to.”

In recent years the original NuGen consortium members all abandoned the scheme, leaving Toshiba sole bearer of the risk.

Toshiba bought 60% of the shares in June 2014 from Spanish company Iberdrola and France’s Engie (formerly GDF Suez), and the remaining 40% in July 2017, when Engie exercised its right to withdraw from the agreement.

However, its determination to press on with the 3.6GW plant was undermined by the bankruptcy of its US nuclear subsidiary Westinghouse last year.

It announced in February 2017 that its losses from the Westinghouse debacle may reach $6.3bn. In light of this, it sought to sell its stake in Moorside and would not take on any of the construction risk for building it.

Toshiba had been hoping to find a buyer for NuGen, and had been in talks with South Korean utility Kepco and China’s State Nuclear Power Technology Corporation to sell some or all of its stake, but these talks came to nothing.

The Moorside project was given the green light by the UK government in June 2011. Site investigation work commenced in August 2014, and the scheme underwent public consultation. NuGen had hoped to begin electricity generation in 2025.

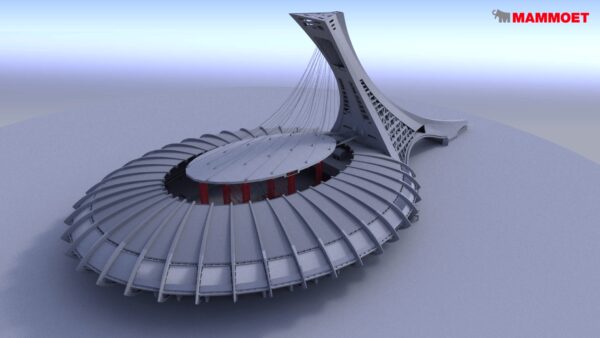

Image: The Moorside plant was to have housed three Westinghouse AP1000 reactors and supplied 7% of the UK’s electricity (NuGen)

Further reading:

Comments

Comments are closed.

Well, stop using foreign firms and rely on British firms.

Unfortunately there are no British firms with the reactor Design Authority rights and obligations (to take the risks) for such large scale commercial reactors.

Toshiba’s problems arose, in part, because of its purchase and ownership of Westinghouse; one such example.

The problems of design completion, (as well as in construction time and cost) for next generation reactors, of whichever type, are legion.