Academics at Michigan University argue that China’s property-sector woes may have causes beyond the overambition of developers and the government’s actions to limit the ballooning debt in the sector.

Led by Lan Deng, professor of planning at the university, the research looked at how the structure of China’s housebuilding industry changed between the early 2000s and 2018.

It found that the industry became dominated by a small number of large firms who used their ability to access debt and land at low cost to create an oligarchic market.

The fact that the major companies followed the same high-risk, high-growth business strategy meant they were all vulnerable to an economic shock.

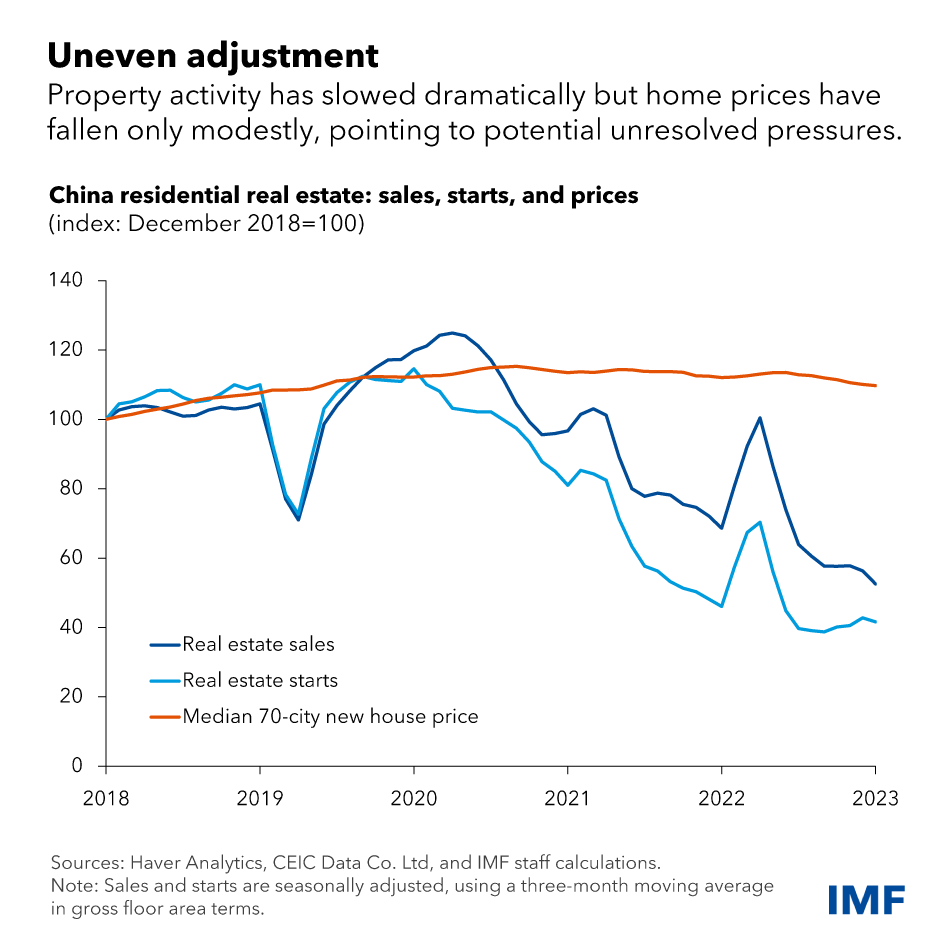

In the event, the default of Evergrande in 2021, set off a progressive collapse in its rivals and led to China’s continuing property crisis.

Published in the journal Housing Studies, the paper found that there were about 10,000 registered developers in China, but that the top five accounted for 30% of domestic housing supply in 2018, compared with 13% in the much smaller US market.

Evergrande, which once built as much as 72 million sq m of property in a year, filed for bankruptcy protection in August 2023.

Country Garden, whose annual housing production was about twice the size of Evergrande’s, followed suit two months later.

‘Three red lines’

The collapses were precipitated by government concern over the disproportionate role these companies were playing in the national economy, and the extent of their debt.

It brought in the “three red lines” rules in 2020, which put a sudden end to the high-leverage, high-turnover, high-profit business model.

This led to a default on dollar bonds issued in Hong Kong and yuan-denominated bonds in mainland China.

The developers were particularly vulnerable because of their use of buyers’ down payment and mortgage loans. These were transferred to the companies during the development process and used as development capital.

Again, the size of the developers created a snowball effect, because buyers believed their deposits would be safer if given to a big, well-established company.

Another factor was the use of land auctions. In China, state land is sold to the highest bidder, and the large developers always had the resources to outbid smaller rivals.

China Daily notes that the property sector remains critical for the Chinese economy.

It points out that, even after the collapse of the two largest companies, it still contributes 20% of fiscal revenue, stores 70% of household wealth, generates 24% of GDP and accounts for 25% of bank loans.

- Subscribe here to get stories about construction around the world in your inbox three times a week.

Further reading: