Chinese companies are playing huge role in bringing electricity to sub-Saharan Africa and can take credit for 30% of new capacity in the region, according to a study published this week by the International Energy Agency (IEA).

While more than 635 million people still live without electricity there, Chinese companies channeling state funds into all different types of power stations will have brought light and power to around 36 million people by 2020.

African countries have relied heavily on China to support the expansion of their electricity systems, to enable growth and improve living standards– Paul Simons, IEA Deputy Executive Director

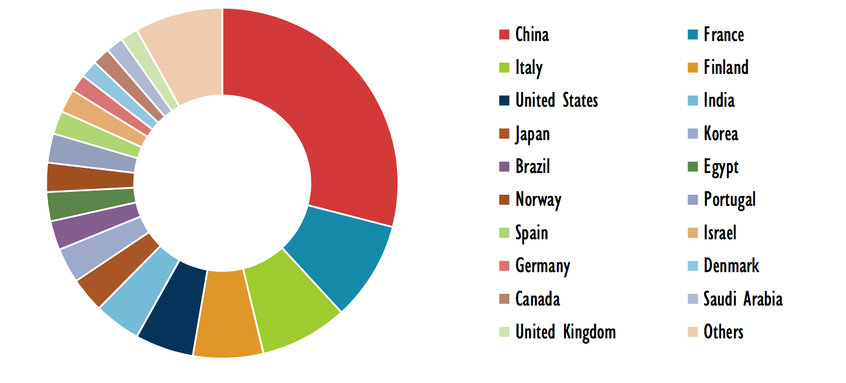

The sums are vast: the IEA finds that China invested around $13bn between 2010 and 2015 in power projects, as China’s contribution dwarfs that of any other non-African country.

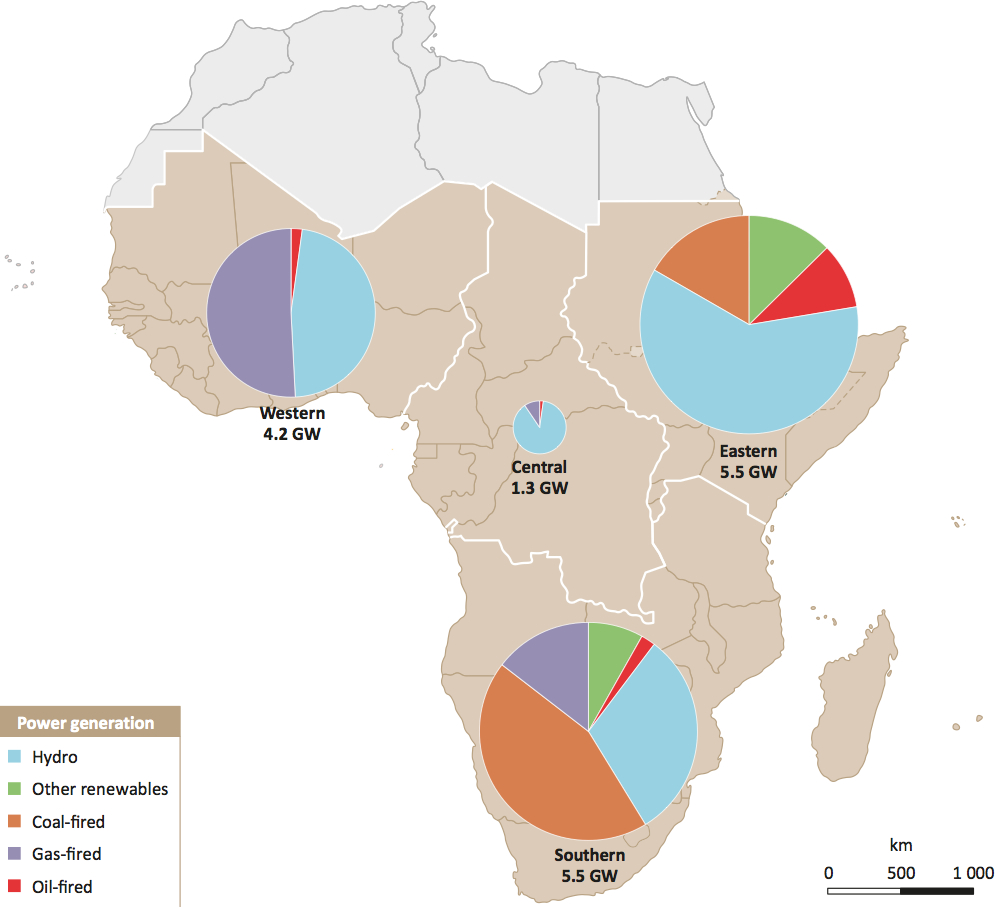

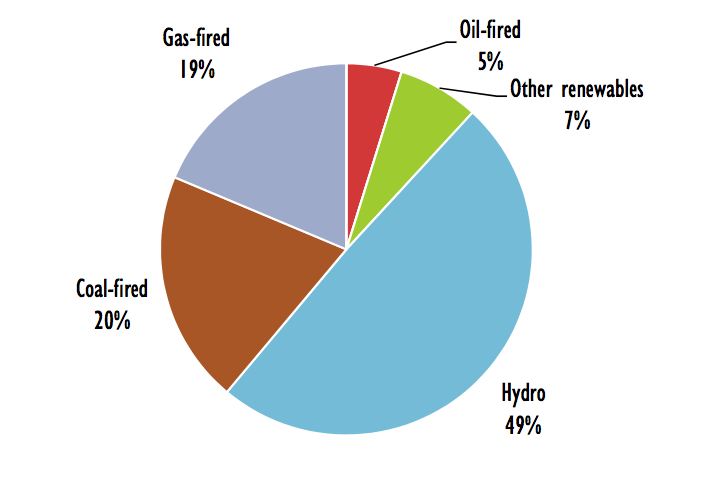

Over half of all power projects are based on renewable sources, of which most are hydropower, the study, Boosting the Power Sector in Sub-Saharan Africa: China’s Involvement, reveals.

“African countries have relied heavily on China to support the expansion of their electricity systems, to enable growth and improve living standards,” said Paul Simons, the IEA’s Deputy Executive Director, on the report’s launch.

Mutual benefits

Between 2010 and 2020, a total of 120 million people will have gained access to grid electricity. Thirty-six million of these, or 30%, will have done so thanks to Chinese contractors. China also provides off-grid power with solar energy kits donated in countries like Rwanda and Comoros.

Distribution of Chinese projects in power capacity, by sub-region, 2010-20 (IEA)

Benefits flow both ways. China’s involvement in Africa bolsters the internationalisation of Chinese companies, in line with the government’s “Go Out” policy initiated in 1999. Meanwhile, the current economic slowdown in China and overcapacity in various sectors further impels Chinese companies to search for new markets overseas.

There is also a long-term strategy behind China’s powering of Africa. The industrialisation and economic development of the region is seen by Chinese stakeholders as important for eventually bolstering Chinese exports to the region, the IEA says.

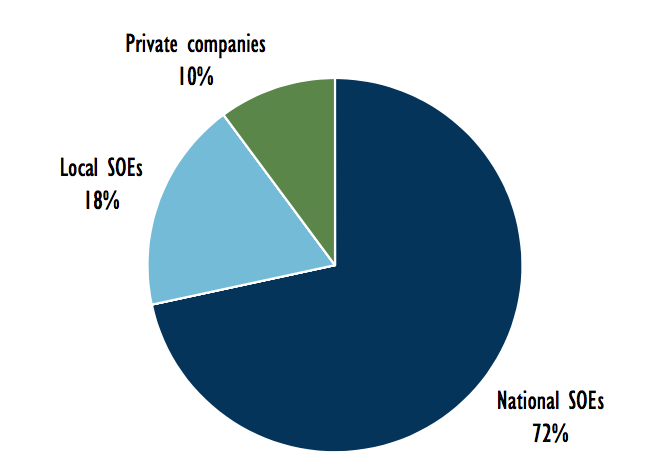

This is why the state plays such a large role. Over 90% of Chinese-built power projects in the region are contracted by Chinese state-owned enterprises (SOEs). Africa is the largest overseas market for some major Chinese energy infrastructure SOEs, which provide integrated services centred on turnkey projects.

Doing it all

Generally with Chinese government support, Chinese stakeholders provide integrated solutions – power generation capacity plus transmission and distribution – through a combination of Chinese loans, government-driven investment and equity investment.

Headquarters of foreign contractors for greenfield power plants in sub-Saharan Africa, 2010-15

China’s approach to development assistance differs from OECD countries. For example, China is not covered by the Arrangements on Officially Supported Export Credits, which guides OECD countries in export credit financing.

In the 2010-15 period, loans, credits and foreign direct investment from China into the sub-Saharan power sector amounted to around $13bn, around one-fifth (20%) of all investments in the sector. Most of this financing comes from the Export-Import Bank of China.

According to the IEA, construction costs of power plants built by Chinese builders are lower overall than in other parts of the globe but higher than those for plants built in China.

Ever-rising demand

Over 635 million people live without electricity in the region, which severely constrains economic growth. Manufacturing, healthcare and education all rely on reliable sources of electricity. The IEA also believes the lack of power also holds back the region’s agriculture sector, which remains unmodernised and accounts for 20% of regional GDP and 65% of employment.

Over 90% of Chinese-built power projects are contracted by Chinese state-owned enterprises (SOEs) (IEA)

Demand will only get more acute, according to the IEA. It says sub-Saharan electricity demand is expected to more than triple by 2040, to reach 1,300 terawatt hours (TWh) under current and proposed government policies and measures.

By 2040, demand from industry will double while residential demand will grow by more than five times current levels. At a rate of 6% per year, electricity demand growth will therefore exceed GDP growth throughout the next 25 years to 2040.

Chinese-added generation capacity mix in sub-Saharan Africa, 2010-20. Other renewables includes solar, wind, biomass and waste. (IEA)

On the plus side, it says, sub-Saharan Africa has ample primary energy resources to meet this demand: recoverable oil resources will be sufficient for the next 100 years, coal for over 400 years and gas for 600 years, and renewable energy sources (geothermal, hydro, wind and solar) are abundant.

- To explore in more detail, view the report here.

Top Image: The Bui Dam, a 400-megawatt hydroelectric scheme on the Black Volta River in Ghana, part-financed by China and built by Sinohydro (ZSM/Wikimedia Commons)