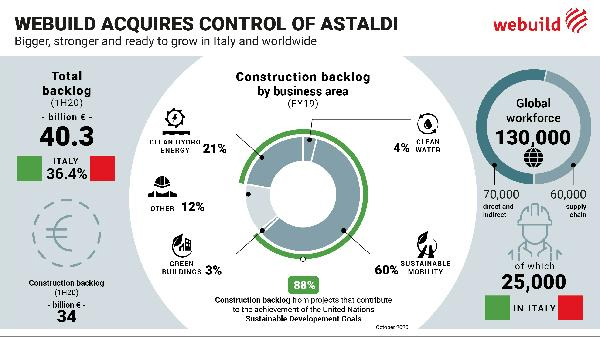

Italian contractor Webuild has completed its acquisition of Astaldi, Italy’s second largest contractor, to create the country’s largest construction group, with 70,000 staff and a €40bn order backlog.

Webuild, formerly known as Salini Impregilo, acquired 65% of Astaldi’s shares, ending a two-year acquisition saga.

Webuild said the new group would specialise in large infrastructure projects in the fields of sustainable mobility, hydropower, water and sustainable buildings.

Pietro Salini, the chief executive of Webuild, commented in a press statement: “This is a moment that evokes a great sense of accomplishment. It opens the way for a bigger and more competitive group that looks at the future of the sector in Italy with optimism.”

National champion

He added that the deal was a landmark for “Progetto Italia”, Webuild’s idea to consolidate Italy’s fragmented infrastructure sector and give it a national champion able to compete against international megacontractors that dominate the market for large infrastructure schemes. Â

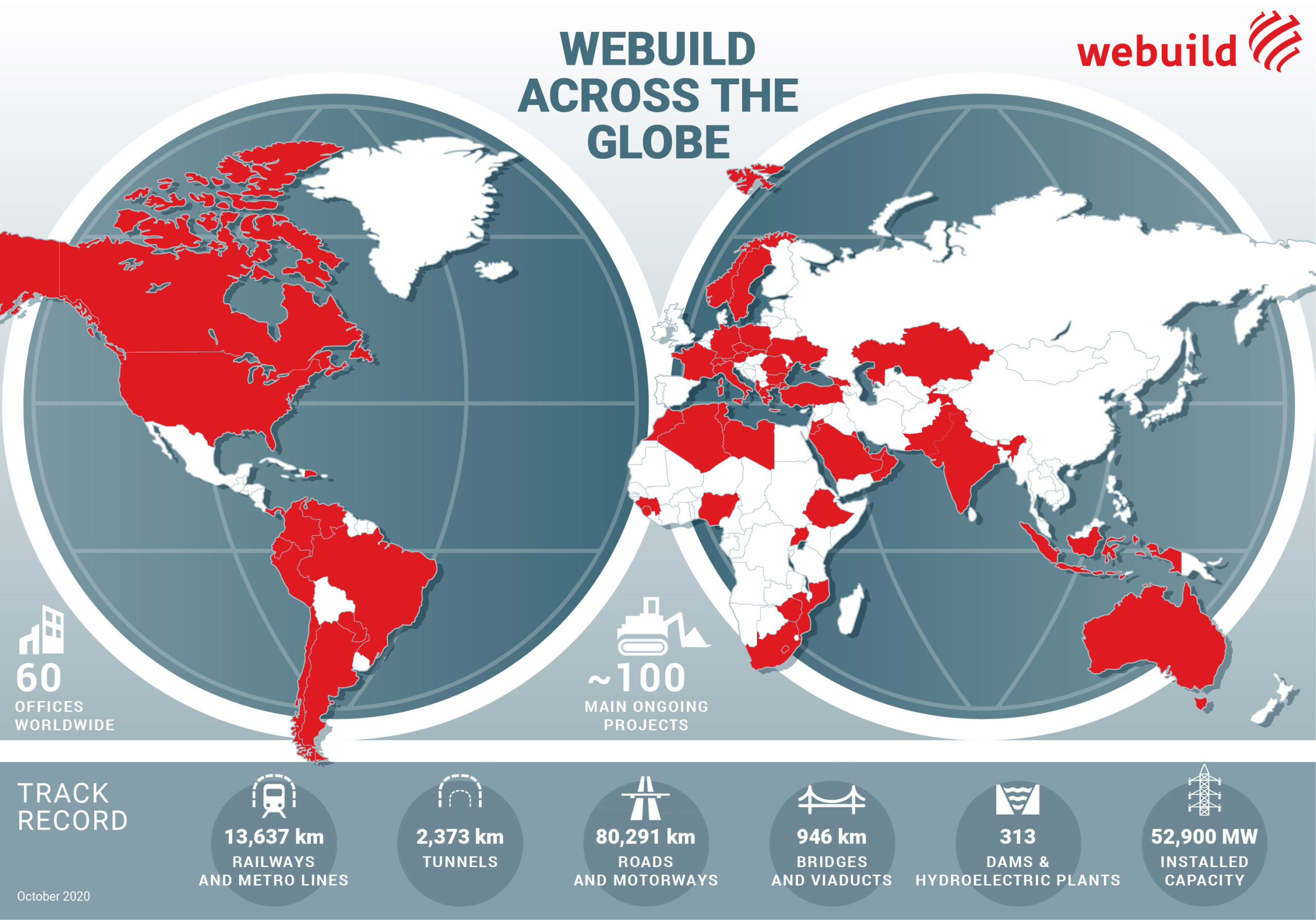

The new Webuild’s global reach

He said: “Our group will have more than 70,000 people and an order backlog of nearly €40bn. We will be bigger, stronger, better organised and more efficient to compete better together in international markets and relaunch the Italian market for infrastructure.”

Another motive for the acquisition was Webuild’s relative absence from the Italian domestic market.

More active at home

The company noted that most of the world’s top builders get 75% of their revenue in their home markets, citing Vinci in France, ACS in Spain, Skanska in Sweden and Strabag in Austria.

Before becoming Webuild, Salini Impregilo did not. In recent years, it generated less than 10% of its revenue in Italy. It has since come to generate about 20% at home.

Complex negotiations

Webuild began considering the takeover in the second half of 2018, after Astaldi got into financial difficulties that were exacerbated by the delayed sale of its 33% equity stake in the Yavuz Sultan Selim Bridge, which crosses the Bosphorus in Istanbul.

Webuild’s infographic on the expanded company

The remaining two years have been taken up with sourcing investment and untangling Astaldi’s finances. The process involved complex negotiations with Astaldi’s creditors and shareholders, and a number of hearings before the Court of Rome, which had granted the company protection.

In the end, a plan was agreed to separate Astaldi’s non-core assets, including the Bosphorus bridge, into a separate entity that was then liquidated, with the proceeds given to creditors.

This allowed Salini Impregilo to avoid taking on Astaldi’s debt, but meant that the company had to be recapitalised. Webuild eventually raised €600m from an array of Italian financiers, including state investment fund CDP Equity, Intesa Sanpaolo, UniCredit and Banco BPM, as well as a number of private investors.

This has resulted in a change in Webuild’s ownership structure, with the Salini family reducing its holding from more than 60% to less than 50%.

Among the new group’s projects are one of the US’ few high-speed railways, between Houston and Dallas in Texas, the Grand Ethiopian Renaissance Dam, and the Snowy 2.0 hydropower project in Australia.

- The article was amended on 9 November for a number of clarifications and to correct the figure given for Webuild’s recapitalisation

Top image: Pietro Salini is overseeing a three-year business plan for Webuild (Bobard71/Public domain)

Further reading: