Nigeria’s construction industry is waiting with much anticipation to see what the new government of Muhammadu Buhari (pictured) will do to kickstart the country’s needed infrastructure development.

With 55% of the construction industry fuelled by infrastructure spending, it will need a healthy infrastructure programme to flourish.

But the decline in the price of oil over the past year has severely restricted government revenue, since oil accounts for 70% of the government’s income.

Nigeria has just under 200,000km of road compared to the second largest economy on the continent, South Africa, which has 750,000km– RisCura’s 2015 Bright Africa

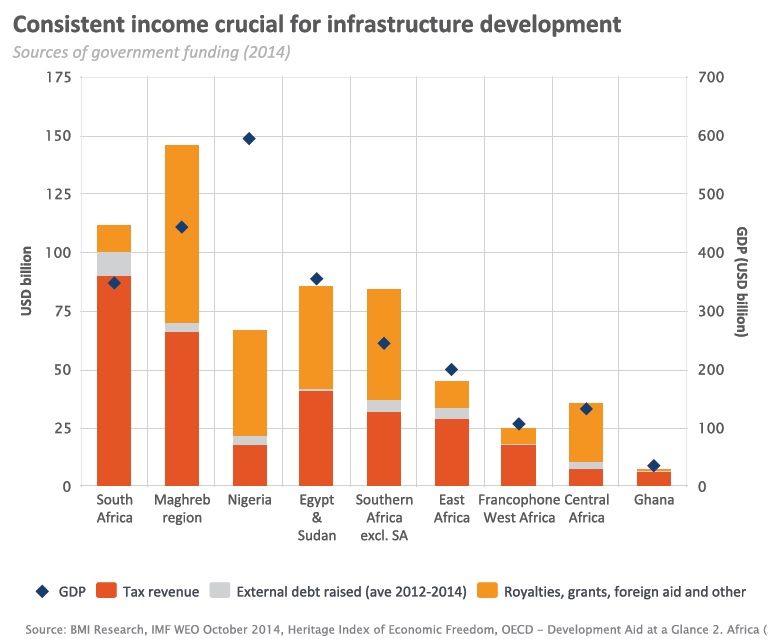

With extremely low consistent income tax revenue, as illustrated below, the funding for the government’s various infrastructure initiatives have come under threat.

The availability of capital from sources inside Nigeria is also limited. President Buhari spoke during his campaign of the establishment of a National Infrastructure Development Bank, but the initial seed funding for this initiative would need to come from the same depleted government coffers that are currently under strain.

The National Sovereign Investment Authority (Nigeria’s sovereign wealth fund) has also recently started funding some of the longer term projects, but this fund is relatively small, and cannot be expected to make up the shortfall in government spending.

The extent of the funding needed to remedy Nigeria’s backlog of infrastructure therefore necessitates the involvement of the private sector.

According to RisCura’s 2015 Bright Africa report Nigeria has just under 200,000km of road compared to the second largest economy on the continent, South Africa, which has 750,000km.

Rail and energy infrastructure present an even more dire picture with 0.004 km of rail per km² of land compared to 0.016 km – four times as much – in South Africa.

The critical shortage of electricity is highlighted by the amount of installed capacity per million people: South Africa outstrips all “MINT” countries (Mexico, Indonesia, Nigeria, and Turkey) at 784 MW per million, while Nigeria trails at a dire 34MW per million people.

The government of Goodluck Jonathan created the National Integrated Infrastructure Master Plan, which gave private investors and developers a strategic investment plan against which they could evaluate the implementation and returns that their projects were likely to earn given the overall development of infrastructure.

President Buhari has expressed interest in both extending this plan and establishing the National Infrastructure Development Bank.

Nigeria has comparatively low income tax revenue to fund infrastructure (Sources: BMI Research, IMF WEO October 2014, Heritage Index of Economic Freedom, OECD – Development Aid at a Glance 2. Africa (2014 edition), RisCura analysis)

The new president can further build on this by giving the private sector clarity and legislative continuity in terms of tolling, contract enforceability and arbitration. In his pre-election pledges, Buhari pledged his administration would:

- Review the Public-Private Partnership (PPP) enabling environment with a view to addressing the legal, regulatory and operational bottlenecks, challenging the effective administration of the system, by introducing enabling legislation;

- Embark on a National Infrastructural Development Programme as a PPP that will (a) ensure 5,000km of superhighway, including service trunks and (b) building of up to 6,800km of modern railway completed by 2019;

- Enact new legal and regulatory frameworks to establish independent regulation and incentives to accelerate public and private sector investment in seaports, railways, and inland waterways;

- Embark on PPP schemes that will ensure every one of the 36 states has one functional airport, with all 21st century safety tools.

Like all election promises, these may prove difficult to keep under severe fiscal pressure.

Along with the enabling environment set out above, the reduction of the rampant corruption is the single biggest enabler for the infrastructure and construction industry in Nigeria to flourish.

As president Buhari’s campaign was essentially an anti-corruptionticket, the construction industry, like the rest of Nigeria, waits to see how this mandate will be enacted.

Heleen Goussard is an Associate at RisCura. The 2015 Bright Africa report is here.