The government of cash-strapped Egypt is working out how to compensate construction companies who are losing money on strategic government schemes after the plunge in the value of the Egyptian pound.

Responding to industry calls, the government has set up an emergency committee to calculate how much more companies should be paid, since original contract prices reflected a currency pegged at 6.9 to the dollar.

Having floated the currency to receive a $12bn bail-out from the International Monetary fund (IMF), the Egyptian pound is now at 17.5 to the dollar, causing a large hike in the cost of imported materials – and the decimation of expected profit margins.

The amount of money that each company will receive is to be determined next year by the Construction Companies’ Compensations Committee, which has been set up by the Egyptian parliament to administer a law that will be passed by the end of the month.

Mohamed Naser, the head of the committee, told Daily News Egypt that the calculation will involve a certain percentage of the value of each contract, as well as a “mechanism” that had still to be decided. The value of the percentage and the nature of the mechanism is being discussed by the ministries and government agencies that make up the committee. Once an agreement has been reached, it will be presented to parliament to be written into the new law.

Naser added that the decision to reimburse companies’ costs was prompted by complaints by companies exposed to the collapse in the value of the Egyptian pound and lobbying by the Egyptian Federation for Construction and Building Contractors.

The collapse in the value of the Egyptian pound

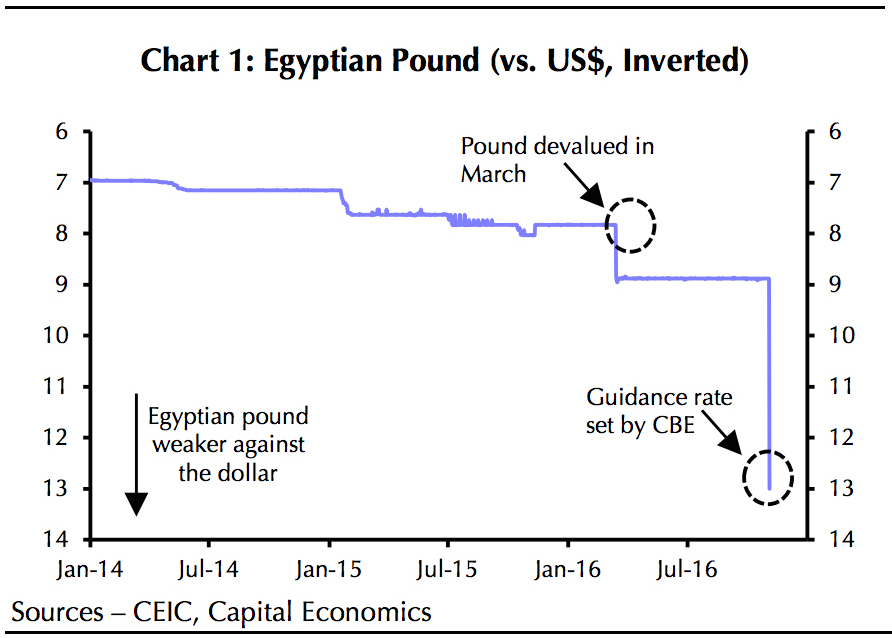

The fall in the currency has mostly occurred in the past year. When the government of the Muslim Brotherhood was ousted in July 2013, the pound was pegged to the US dollar and the exchange rate was 6.9 pounds. There was a 13% devaluation of the official rate in March of this year, partly in response to the weakness of Egypt’s foreign currency reserves.

To bolster these reserves Egypt has negotiated a $12bn loan from the International Monetary Fund, as a result of which it agreed to remove the dollar peg and allow the pound to float.

This took place on 3 November, since when the pound has fallen to around 17.5 to the dollar, which in turn has forced the central bank to raise interest rates 5% to prevent further falls and pre-empt a surge in inflation. Â

Among those affected by the evaporating value of the pound are construction companies, who have to import a high proportion of the materials they use on Egyptian construction projects.

President Abdel Fattah al-Sisi, who took power in a coup, had hoped to ward off political turmoil by investing in infrastructure of all kinds, with affordable housing and electricity top priorities.

This strategy is now threatened by the shortage of foreign exchange, the fall in the value of the pound and the surge in inflation. The compensation scheme is a rapid response to these developments, and an attempt to persuade companies to continue with state-sponsored projects that may now be loss-making. The question is, how long will it be in operation?

Top image: Egypt largest public sector scheme is a new administrative capital (Capital City Partners)

Further Reading: