After losing nearly $1bn on a project to build a liquified natural gas (LNG) plant in Louisiana, Japan’s Chiyoda has been thrown a $1.4bn lifeline by two other Japanese companies who are betting the sector will be profitable.

The company suffered a $953m loss in the six months to 30 September 2018 after costs got out of control on the $10bn Hackberry LNG plant in Louisiana, largely, it said due to skyrocketing labour costs

Chiyoda is expected to record a net loss of about $1.4bn for the year to March.

Now Mitsubishi Corp, which owns a 33.4% stake in Chiyoda, and the Mitsubishi UFJ Financial Group have agreed to provide capital while the company implements a rescue strategy, the Nikkei Asian Review reports.

The companies’ boards will meet later this month to formally approve the plan.

Mitsubishi is supporting Chiyoda on the grounds that the market for LNG plants will grow as environmental regulations around the world became more stringent. A recent report from the business consultant McKinsey found that in China alone, LNG import volumes grew at an annualised rate of 52% during the first half of 2018, and new projects are expected to add 48 billion cubic metres a year.

Chiyoda is one of four companies capable of building large plants, alongside Japan’s JGC, the UK’s TechnipFMC and Bechtel of America. According to the Nikkei Asian Review, Chiyoda enjoys a technical advantage over its rivals.

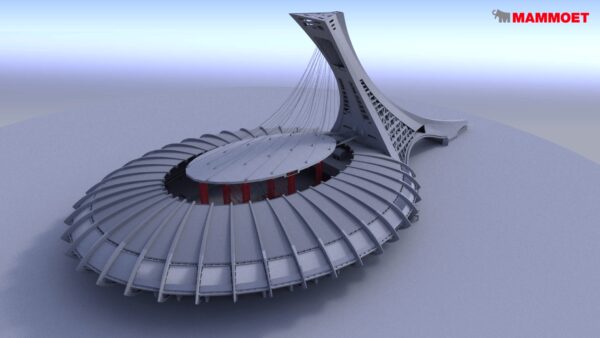

Image: The Qatargas 4 LNG plant (Shell)

Further reading