A report on China’s residential real estate market released by the Royal Institution of Chartered Surveyors (RICS) suggests that debt among mainland Chinese residential property developers has grown to historic levels since the global financial crisis, threatening stability and growth.

China’s unprecedented expansion in debt, in terms of volume as well as rate of increase, now exceeds that of Japan’s in the late 1980s, with the possibility of a major credit event becoming more likely in the next two years, says the report.

It says the impact of such an eventuality would be felt far beyond China’s domestic property sector, affecting not only China’s future growth trajectory but also global economic growth.

RICS predicts that a spike in construction costs and Chinese developers’ diminished access to financing will hurt their finances from mid-2018.

It bases its prediction on the Chinese government’s current credit tightening policy, and on projected construction schedules.

Based on normal development schedules, construction is due to begin on these projects, and developers depend on pre-sales to help pay for construction.

These pre-sales would normally begin from the middle of 2018, RICS said in a statement, adding: “As a result of this significant cracks will begin to emerge in developers’ balance sheets.”

Commenting on the growing strain on developers, Sean Ellison, RICS Senior Economist Asia-Pacific said: “Access to cheap credit has resulted in unsustainable land price inflation in China. Residential property developers are now seeing funding avenues dry up as they need to pay for construction on these projects. As we enter 2018, policymakers must decide whether to risk financial contagion in the short-term by allowing some developers to default, or risk inflating the bubble further by continuing to extend credit to the sector.”

Systemic risk

While under pressure to finance highly inflated land prices amid tighter lending conditions, Chinese developers also face a growing slew of government restrictions to keep housing prices in check, further straining their balance sheets in ballooning the overall level of leverage, which risks spreading to China’s broader financial system, the RICS said.

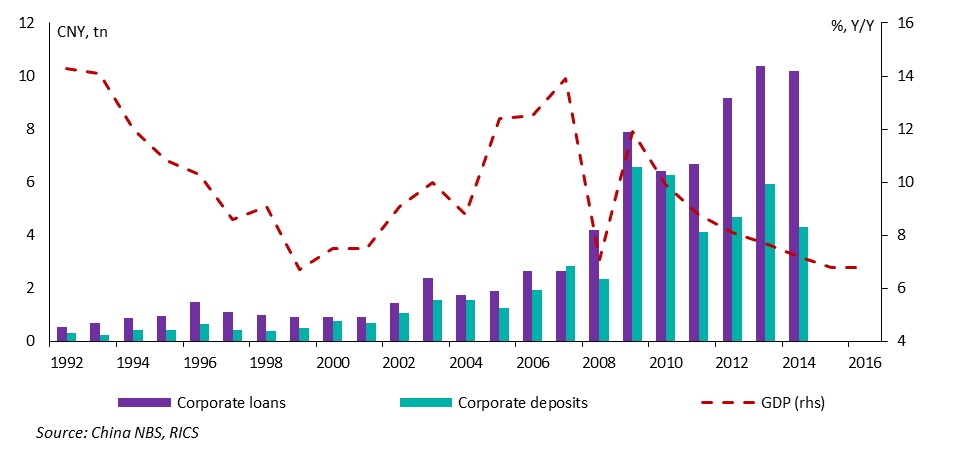

Chart shows growing gap between corporate loans and deposits in China (China NBS, RICS)

This is particularly acute in second tier markets, which have seen an abundance of speculative activity, and among smaller developers who have less access to traditional financing and are more reliant on the shadow banking system.

“What remains unknown is how interconnected the shadow and formal banking systems are and whether the prospect of a developer defaulting would spark systemic risk,” RICS said in a statement.

The professional body continued: “Authorities could attempt to mitigate any crisis in the short term by continuing to extend credit to developers. However, new credit faces diminishing productivity and there is evidence that new lending has been used to pay off old loans.”

Along with its report RICS produced a chart showing the gap that has grown between corporate loans and deposits, which it said shows that “fewer loans are being used to generate real economic activity”.

Far-reaching implications

As China seeks to address economic vulnerabilities and undertake structural reform as growth slows, Chinese policymakers “need to confront the realities of excessive debt head-on or reverse its de-leveraging drive and continue support developers with cheap and accessible funding”, RICS said.

However, the former approach risks destabilising the financial sector, while the latter could result in a “Japanese-style productivity drain” and further inflate asset-price bubbles, RICS added.

“Even as uncertainties mount over China’s efforts to rebalance itself economically and financially, it must be recognised that China is more important than ever for the global economy and has been a critical pillar of global demand since the onset of the Global Financial Crisis,” RICS concluded. “Whatever decisions the Chinese government makes in the next 18 months will have implications that reach far beyond its borders.”

Top image: Shopping mall and development in Hefei city, China (Achy0701/Dreamstime)