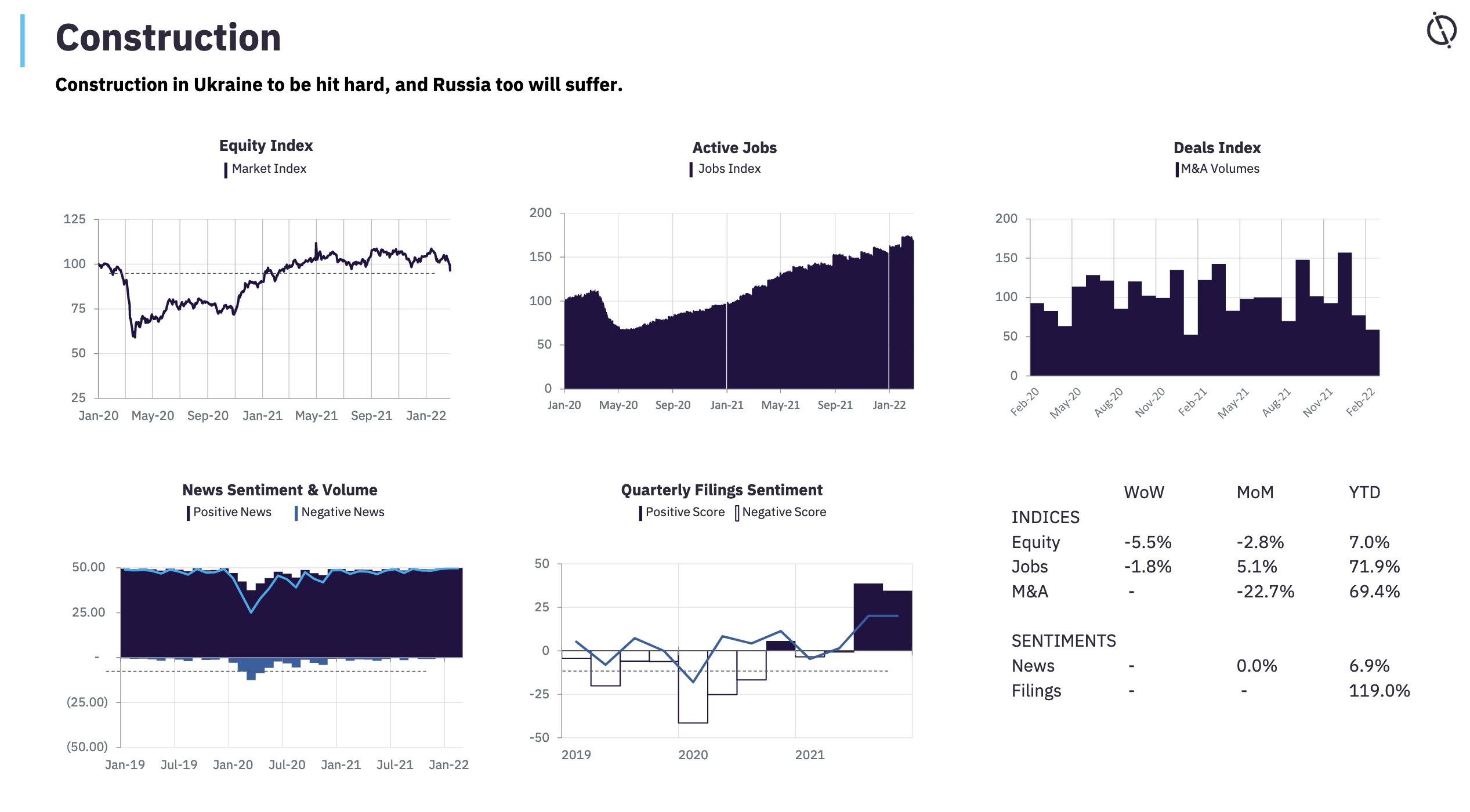

According to research conducted by economic analyst GlobalData, companies boycotting Russia after the invasion of Ukraine will not suffer large economic losses, but the moves will damage the construction industry at large, in terms of material and energy price hikes and supply chain disruption.

Many architecture, construction and materials companies are exiting Russia, but GlobalData estimates that the withdrawals will not seriously harm their revenue.

Russia will also be largely unaffected by the withdrawals, since foreign direct investment accounts for only 1% of the value of its projects. Furthermore, the largest source of investment is Chinese companies, who have some 30 developments in progress, and are not withdrawing from the market.

GlobalData has looked into some of the large companies who have boycotted the country:

- America’s Aecom previously employed 350 staff in Russia, and expects a one-time loss of between $40m and $50m in the second half of the financial year

- Australian headquartered engineer Worley has confirmed that its withdrawal will not be detrimental to its global business

- Finnish service provider SRV Group has stopped buying materials from Russia, but is continuing to operate three shopping centres in the region. It generated 0.7% of its revenues from Russia in the 2021 financial year, equating to €6.8m.

The consultant predicts that the Russian government will seize the assets of foreign companies that have ceased trading in the country, but global companies will not be significantly affected by such moves.

It also predicts significant disruption to the delivery and production of construction equipment in Russia, now that equipment makers such as Caterpillar, Hitachi and JCB have suspended delivery and manufacturing.

The businesses themselves will not be hard hit:

- Hitachi’s operations in Russia and the Commonwealth of Independent States (CIS) accounted for 2.8% of its revenue

- Komatsu’s work in Russia and the CIS accounted for 5.1% of its revenue

- During the same period, John Deere derived 6.1% of its revenue from the Central Europe and CIS region.

Real estate companies such as CBRE, Jones Lang LaSalle, Colliers, Knight Frank and Savills have closed operations in Russia, but much like their construction counterparts, many were operating on a small scale.

GlobalData notes that architects such as Foster + Partners, David Chipperfield Architects, MVRDV, Zaha Hadid Architects and Bjarke Ingels Group have also ceased trading in Russia.

Further Reading: