A decision on whether to proceed with the UK’s new nuclear power station at Hinkley Point in Somerset could come on Thursday, 28 July – earlier than a previous estimate of September.

French energy firm EDF yesterday called a meeting of its board of directors for that day, saying the the final investment decision for the plant would be on the agenda.

The indebted firm, 85% owned by the French state, has been in turmoil over the twin-reactor scheme, known as Hinkley Point C (HPC), with some on its board of directors vehemently opposing it because of the financial risk involved.

An overdue final investment decision on the project, costed by EDF at a nominal £18bn, has been postponed multiple times.

HPC is a unique asset for French industry as it would benefit the whole of the nuclear industry and support employment in major companies and smaller enterprises in the sector– EDF statement

In April French economy minister Emmanuel Macron told a newspaper that a decision on the project, for which EDF has teamed up with a Chinese nuclear power company, could be delayed until September.

The board meeting on Thursday follows a 60-day internal consultation at EDF, which ended 4 July.

In its statement EDF cast the scheme in a positive light. “The HPC Project is a major element of the Group’s CAP 2030 strategy,” it said.

“The two EPR reactors at Hinkley Point would strengthen EDF’s presence in Britain, a country where its subsidiary EDF Energy already operates 15 nuclear reactors and is the largest electricity supplier by volume.

“HPC would also enable the Group to mobilise all its significant nuclear engineering skills following the final investment decision.”

EDF said the first concrete at HPC is scheduled to be poured in mid-2019.

It added: “HPC is a unique asset for French industry as it would benefit the whole of the nuclear industry and support employment in major companies and smaller enterprises in the sector.”

In October 2015 EDF struck a deal with state-owned China General Nuclear Power Corporation (CGN) which sees EDF taking a 66.5% share in the plant, and CGN taking a 33.5% share. The plan is for the consortium to recoup its investment by selling electricity to the UK grid for a high guaranteed price for 35 years.

EDF is also struggling to complete two other nuclear stations, at Flamanville in France and Olkiluoto in Iceland, each of which is billions of dollars over budget and years behind schedule.

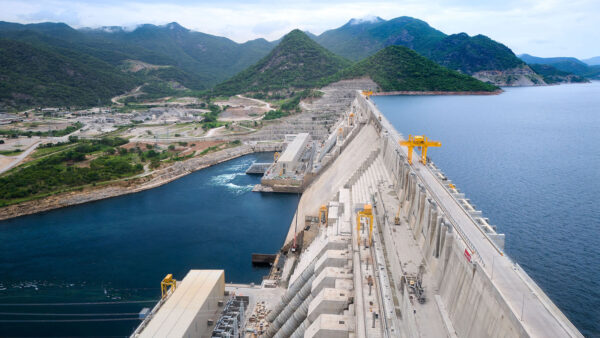

Image: Artist’s render of the new twin-reactor power station, Hinkley Point C (EDF)